Anil Ambani Net Worth 2024: Anil Ambani, a prominent Indian businessman and the younger brother of Mukesh Ambani, has had a career marked by both significant achievements and notable challenges.

RELATED: KL Rahul Net Worth 2024: How Much is the Indian Cricketer Worth?

RELATED: Anupam Mittal Net Worth 2024: How Much is the Shark Tank India Judge Worth?

As the head of the Reliance Anil Dhirubhai Ambani Group, he has been a key figure in sectors such as telecommunications, infrastructure, finance, and entertainment. This article delves into Anil Ambani’s net worth as of 2024, exploring the various factors that have influenced his financial standing.

Table Of Contents

Peak Wealth and Subsequent Decline

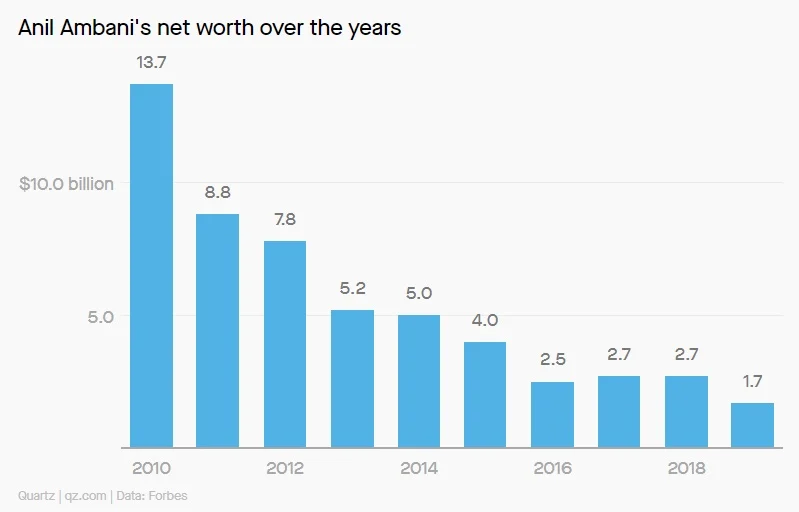

Anil Ambani’s financial journey has been a rollercoaster ride, with his net worth reaching its zenith in the mid-2000s when he was listed as the sixth richest person in the world. However, the years that followed saw a dramatic decline in his wealth due to a series of business setbacks and legal challenges.

The Decline: Reasons and Implications

Reasons for Failure

- Lack of Proper Planning: Anil Ambani’s hasty pursuit of new projects without adequate planning led to significant losses.

- Cost Overruns in Telecom Sector: Ambani’s ambitious foray into the telecom sector resulted in exorbitant costs with minimal returns, contributing to his downfall.

- Lack of Focus and Business Jumping: An inability to concentrate on one business and frequent shifts between ventures drained resources without yielding significant results.

- Debt Accumulation and Overreliance on Borrowing: Anil Ambani’s projects faced cost overruns, necessitating additional equity and loans, thereby escalating debt burdens.

- Ambitious Decision-making without Strategy: Ambani’s penchant for entering competitive arenas without a coherent strategy, coupled with the 2008 global recession, exacerbated his financial woes.

Implications

The cumulative effect of these factors has led to a startling decline in Anil Ambani’s net worth, with recent estimates pegging it at zero. Legal battles and debt repayment obligations further compound his financial challenges.

Average Annual Income and Investments – Anil Ambani Net Worth 2024:

| Estimated Net Worth 2024 | $0 million |

| Estimated Net Worth 2021 | $0 million |

| Estimated Net Worth 2020 | $0 million |

| Estimated Net Worth 2019 | $3 Million |

| Estimated Net Worth 2018 | Rs. 109 Crores |

| Estimated Net Worth 2017 | Rs. 309 Crores |

| Average Annual Income | Rs. 186 Crores |

| Personal Investments | Rs. 195 Crores |

| Luxury cars | Rs. 20 Crores |

Key Business Ventures Impacting Anil Ambani’s Net Worth

Anil Ambani’s net worth has been closely tied to the performance of his business ventures. Here’s a look at some of the key sectors and companies that have played a role in shaping his financial landscape.

Telecommunications: Reliance Communications

Once a flagship company of Anil Ambani’s portfolio, Reliance Communications faced severe challenges, including intense competition and regulatory issues, which led to its decline.

RELATED: Sundar Pichai Net Worth 2024: How Much is the Google CEO Worth?

RELATED: Hardik Pandya Net Worth 2024: How Much Does the Indian Cricketer Earn?

Infrastructure: Reliance Infrastructure

Reliance Infrastructure, another major company under Anil Ambani’s leadership, has been involved in various infrastructure projects across India. The performance of this sector has had a mixed impact on his net worth.

Finance: Reliance Capital

Reliance Capital, the financial services arm of the Anil Ambani Group, has been involved in a range of services, including asset management and insurance. The financial health of this company has been a significant factor in Anil Ambani’s wealth.

Entertainment: Reliance Entertainment

Reliance Entertainment has made forays into the entertainment industry, including film production and distribution. While it has had some successes, its contribution to Anil Ambani’s net worth has been variable.

Asset Diversification and Investments

Anil Ambani’s approach to investments and asset diversification has also influenced his net worth. His portfolio has included a mix of real estate, stocks, and other assets.

Real Estate Holdings

Real estate investments have been a part of Anil Ambani’s asset portfolio, with holdings in various parts of India and abroad. The real estate market’s volatility has impacted the value of these investments.

Equity Investments

Anil Ambani has held stakes in various companies through equity investments. The performance of these stocks has been a contributing factor to the fluctuations in his net worth.

Philanthropy and Social Contributions

Despite the ups and downs in his financial status, Anil Ambani has been involved in philanthropic activities, which have included contributions to education, healthcare, and social welfare.

Education Initiatives

Anil Ambani has supported educational initiatives, including scholarships and infrastructure development for educational institutions.

Healthcare Contributions

Healthcare projects have also been a focus of Anil Ambani’s philanthropic efforts, with contributions to hospitals and medical research.

Public Perception and Media Coverage

The media has closely followed Anil Ambani’s financial journey, with his net worth being a subject of much speculation and discussion. Public perception has been shaped by both his business acumen and the controversies surrounding his companies.

Media Scrutiny

Anil Ambani’s financial affairs have been under intense media scrutiny, particularly during periods of legal battles and debt negotiations.

Influence on Shareholder Confidence

The public perception of Anil Ambani has had a direct impact on shareholder confidence and, by extension, the market value of his companies.

Future Prospects and Potential Recovery

Looking ahead, there are several factors that could influence Anil Ambani’s net worth in the future, including business restructuring, debt resolution, and market conditions.

Business Restructuring

Anil Ambani has been working on restructuring his businesses to reduce debt and streamline operations, which could positively impact his net worth.

Market Opportunities

Emerging market opportunities, particularly in the digital and renewable energy sectors, may offer avenues for Anil Ambani to rebuild his wealth.

RELATED: Kiara Advani Net Worth 2024: How Much is the Bollywood Star Worth?

RELATED: Ashneer Grover Net Worth 2024: Investments, Salary & Income

Conclusion

Anil Ambani’s net worth in 2024 reflects the complexities of his business empire and the volatile nature of the markets in which he operates. From the dizzying heights of being one of the world’s richest individuals to facing significant financial challenges, his journey underscores the unpredictable dynamics of wealth and business.

Despite this, Anil Ambani’s efforts in philanthropy and potential business restructuring offer a glimpse into the resilience and adaptability that have characterized his career. As markets evolve and new opportunities arise, Anil Ambani’s financial story continues to be one of interest and speculation.

Frequently Asked Questions about Anil Ambani:

- Why has Anil Ambani’s net worth declined so much?

- Anil Ambani’s net worth has plummeted due to various factors, including the global financial crisis of 2008, his business decisions, and the accumulation of debt within his ventures.

- Is Anil Ambani still a billionaire?

- No, Anil Ambani is no longer considered a billionaire by Forbes, as his net worth has dwindled significantly in recent years.

- Did Anil Ambani declare bankruptcy?

- No, Anil Ambani has not declared bankruptcy. However, he has faced financial challenges and has been forced to sell off assets to repay debts.

- What factors have contributed to Anil Ambani’s wealth decline?

- Anil Ambani’s wealth decline can be attributed to several factors, including economic slowdowns, heavy debt burdens within his businesses, and legal and regulatory challenges.

- How is Anil Ambani managing his wealth now?

- Anil Ambani is currently focused on restructuring his business empire’s debt and reducing liabilities. He is also selling non-core assets to raise funds and seeking new investment opportunities to stabilize his financial situation.